How Short Selling Works and How to Take Advantage of It (Part 4)

- George Solotarov

- Hits: 399

Types of Accounts for Shorting Currencies

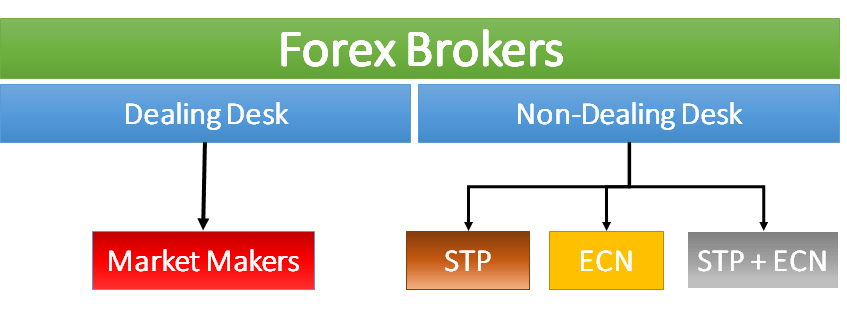

It is more profitable to short the dollar or any other currency on ECN and STP accounts, as well as by trading CFD contracts and futures. Now we will examine in detail the advantages and disadvantages of each option.

ECN/STP

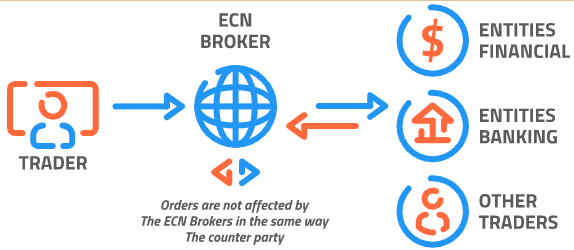

- ECN (Electronic Communication Network), is generally based on a technological solution that provides order matching for all participants in the network, including banks, centralized exchanges, over-the-counter companies, and private clients.

- STP (Straight Through Processing) means that the broker sends all the orders for external execution without interfering in the process, and all transactions are executed at maximum speed. Thus, an ECN/STP broker takes advantage of both systems.

Using the STP model broker concludes the contract with certain liquidity providers (usually 5-10 banks). With ECN all trades of a trader are executed on a single market with a multitude of liquidity providers. In both cases, the trader's orders are executed in the minimum time at the best price of the pool of liquidity providers. The main advantage of the ECN accounts is the variable spread, which can be almost zero if there is a buyer and a seller at the same price. Quotes are always market ones, there are no restrictions in terms of strategies used and one does not need a large deposit. However, with ECN the market dictates the price, so the spread can greatly increase. In the case of STP, the spread is limited by the contract with the liquidity providers.

CFD

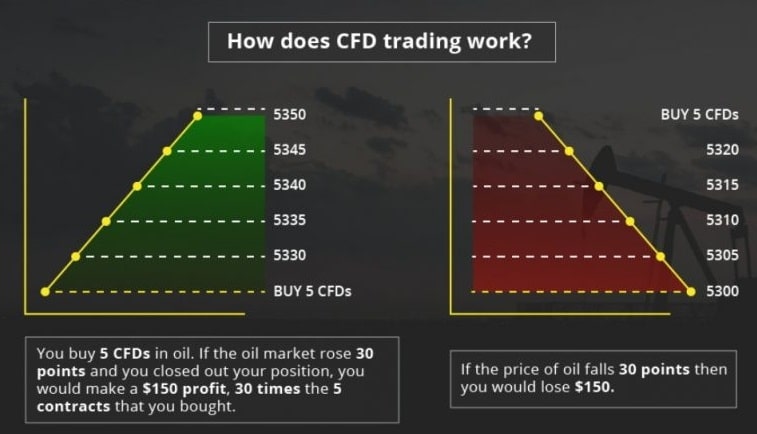

Such a contract is concluded for a certain period of time and the trader receives the difference in the value of the asset at the moment of opening and closing of the transaction. CFDs are characterized by a relatively low margin, there is no need to wait for the confirmation of orders opened, and stop orders are guaranteed to close under any conditions. Other pluses are large leverage and low deposit requirements.

However, forex shorting by means of CFD contracts has a number of disadvantages. For example, it is by no means an investment instrument. The trader does not own the asset itself, all transactions are strictly speculative in nature. In addition, CFD contracts are associated with a high risk that is difficult to diversify, especially when working with large leverage.

Currency Futures

Futures is also a contract. According to it, the seller undertakes the obligation to deliver the asset to the buyer at the price specified and the buyer undertakes the obligation to buy the asset. The main advantages - are there is built-in leverage (as there is no need to pay the contract in full), low commissions, no restrictions for shorting in Forex, and you can hedge positions.

The disadvantages are predictable, first of all, it's the impossibility to "sit out" an unlucky trend. That is, for example, if the price of the asset suddenly went up, it is unprofitable for the trader to wait until it will go down. Firstly, he pays a commission for each day of waiting. Secondly, there is the variation margin due to which it is necessary to either replenish the account or close the position.

_____________________________________

Also, if you want to use all available trading tools to increase your profits as soon as possible - follow this link below, or contact us via live chat. Our experts will help you to choose the best strategy for success.

Follow our updates for useful information in our series of articles. You can also visit our previous article for a better understanding of this topic.