Margin Call in Simple Words: Details and Risks. (Part 1)

- George Solotarov

- Hits: 393

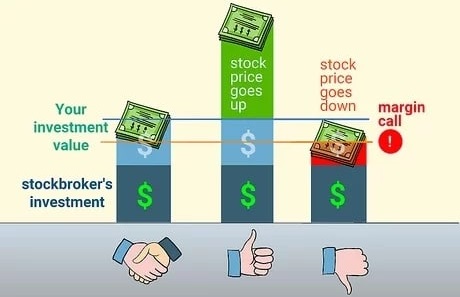

Margin trading allows a trader to participate in trades that require more funds than he has on deposit. Accordingly, the trader's profit from such transactions increases. But margin trading has a flipside - increased risk. It can be minimized by following the rules and taking into account a broker's trading conditions on margin so as not to get a margin call.

A margin call is a notification sent by the broker to the trader when he does not meet the conditions for margin trading. It is a reduction in the amount of the deposit to the level that the broker has designated as the minimum allowable. In this situation, the trader needs to promptly add funds to the deposit up to the required level or... do nothing, hoping that the market situation will change in his favor. Conditions for margin trading can vary quite a lot, they depend on the trading conditions of a certain broker.

It is important to understand when a margin call occurs and how to correctly behave in such a situation. In fact, this is encountered by many traders, and there are those who lose money due to illiterate actions on their part. Because the trader does not react to the notice and the situation continues to worsen, the broker is entitled at his own will to close the trader's positions without any financial and tax liabilities. This can lead to serious losses. In this series of articles, we will examine with examples what a margin call is and how not to encounter its unfortunate consequences.

What is a Margin Call - Definition

So, you want to trade with more than you have in your account. The broker gives you the required funds (provides the leverage) and the margin becomes a part of the amount in your account. For example, if your account has $1,000, $400 as collateral (margin). The broker does not charge you these funds but freezes them in your account, that is, you have free use of $600 (the so-called free margin available for trading).

Obviously, if you begin to lose money rapidly on an open position, there is also a risk for the broker to lose the funds he loaned you. Therefore, you will not be able to lose more than the amount of margin, that is why there is a margin call.

The situation when the quotes moved in the direction opposite to your predictions is not uncommon. As soon as your losses reach a certain value, the broker sends you a message by phone, e-mail, or a push notification in the trading platform, informing you that you need to add funds to your account. This is when the margin call comes in. Note that a margin call is an alert, the broker does not do anything yet, and you have time to react. The main thing is not to take too long to make a decision that minimizes your losses.

In the next article, we'll take a closer look at several different examples of margin calls and understand the mathematics behind them with live examples.

Also, if you want to use all available trading tools to increase your profits as soon as possible - follow this link below, or contact us via live chat. Our experts will help you to choose the best strategy for success.

Follow our updates for useful information in our series of articles.