How does halving affect the bitcoin price? (Part 2)

- George Solotarov

- Hits: 563

Can the date of halving change?

The date of halving depends on when the next 210,000 blocks are mined, that is, on the rate of calculation. The rate of calculation varies, but on average it remains at the same level. The increase in hash rate (mining equipment capacity) due to the price increase is compensated by an increase in the complexity of calculations. And the opposite is true, when the price falls and the hash rate decreases, the complexity decreases. Therefore, the halving schedule is relatively predictable, but shifts are possible for several weeks.

How does halving affect the bitcoin price?

After the first halving of bitcoin in November 2012, the price increased more than 200 times in 6 months. The next halving had a smaller impact on the price. After a reduction in miners' fees in 2016, the BTC price almost doubled in the next 6 months. After the third halving from May to November 2020, the price increased 1.56 times.

The impact of the past halvings on the BTC can be explained by the following reasons:

The significant role of miners in the supply generated in the market. In 2012 and 2016, the value of BTC was significantly lower than in subsequent years. Many people did not understand the cryptocurrency market, so there were relatively few players in the market. Accordingly, the complexity of calculations was relatively low, as well as the cost of equipment. Therefore, mining, which did not require knowledge of analysis, was a more attractive option for earning compared to active trading.

Increased interest in cryptocurrencies due to a chain reaction. Because of the halving, the supply decreased, the price of BTC went up and new investors came to the market has seen opportunities to make money from the price growth. The influx of new investors respectively provoked the next round of prices, making mining even more profitable.

The relatively low price of video cards for mining. Another factor that in the past years has kept the cost of mining low, thus making it attractive to new market participants.

Why the impact of halving is decreasing?

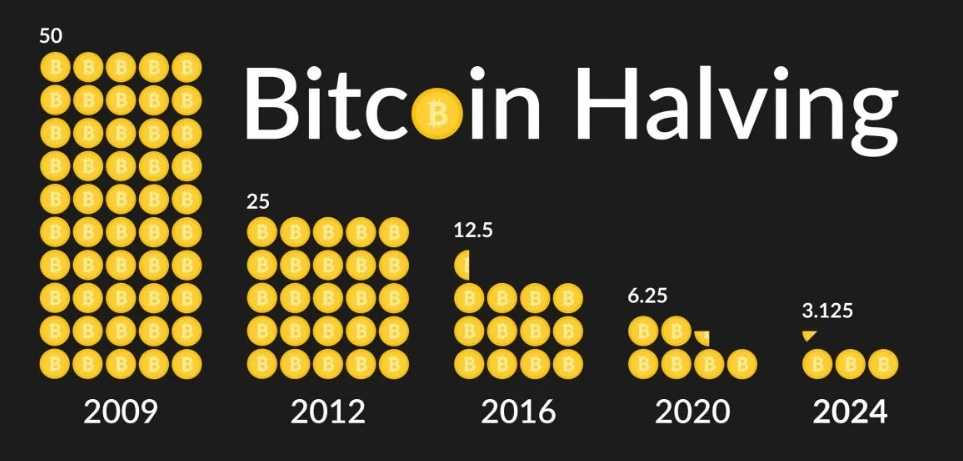

The halving process halved the reward and thereby indirectly influenced the decline in coin supply. But, while in 2012 the reward was reduced in quantity by 25 BTC, in 2020 it is only 6.25 BTC. Also, with each new halving and price increase in the market, the number of active traders and investors increased - the share of miners gradually decreased. This explains the main reason why the role of halving in the formation of the BTC price is gradually decreasing.

______________

Also, if you want to use all available trading tools to increase your profits as soon as possible - follow this link below, or contact us via live chat. Our experts will help you to choose the best strategy for success.

Follow our updates for useful information in our series of articles. You can also visit our previous article to better understand this topic.