The Story of George Soros. Top secrets and tips for traders and investors

- George Solotarov

- Hits: 454

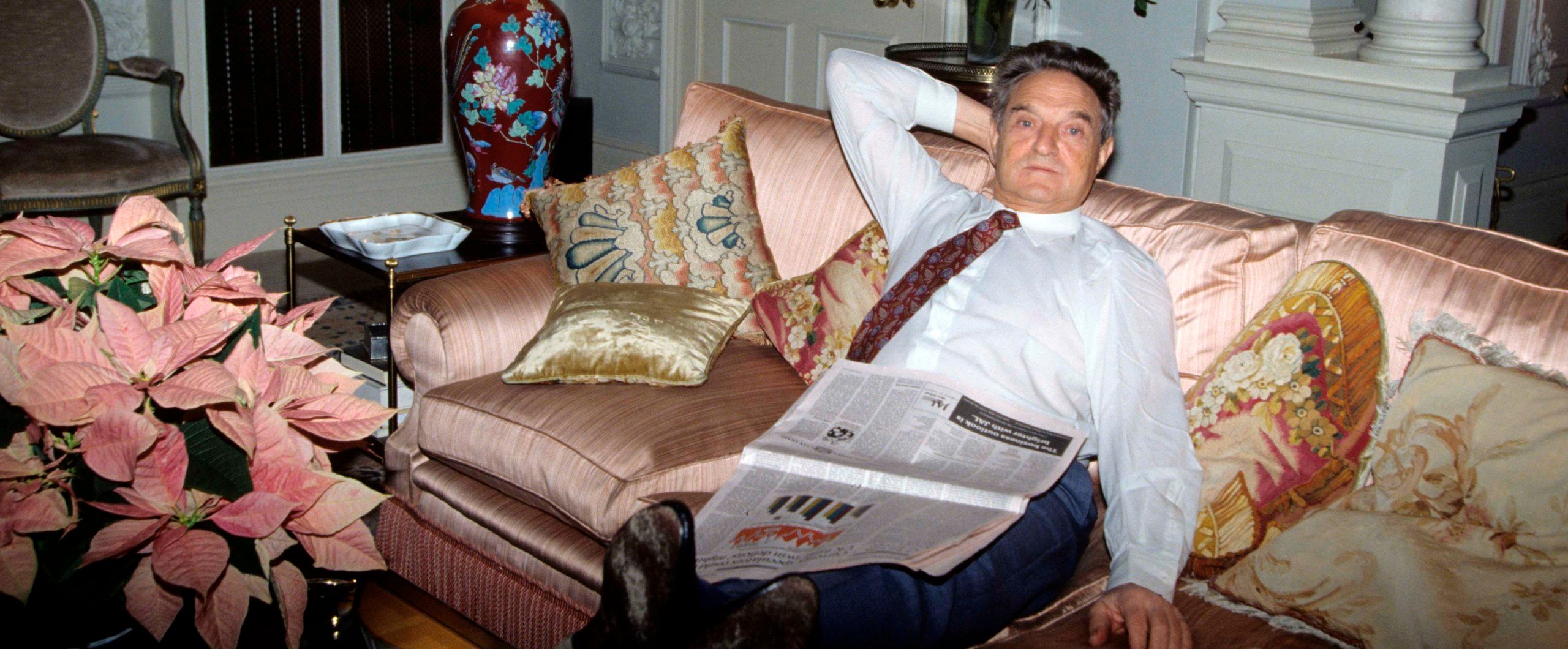

Almost every educated person has heard the name George Soros, a world-class businessman, and investor. Soros manages one of the largest hedge funds and is the owner of enormous capital. Investor created his billion-dollar fortune thanks to accurate forecasts of financial markets movements and his ability to make the right investment decisions. For forty years Soros' hedge fund Quantum Fund provided its investors with stable growth of capital - the average annual return on investments of clients varied within 20-40%. At the moment Forbes estimates the businessman's fortune at $8.6 billion.

Both novice investors and professional market players are interested in questions: how did a beggar emigrant manage to amass billions of dollars in capital? What secrets does he know, and what of his strategies can be applied to his trading systems?

In this series of articles, we will walk the investor's path and break down the key decisions that affect the rate of capital growth. By understanding George Soros' basic principles of investing you will be able to build your investment capital, save and multiply your savings.

Who is George Soros?

George Schwartz was born in Budapest in 1930, the son of Theodore Schwartz, a lawyer. But in 1936 the family was forced to change his name to the Hungarian version of Soros. He was 13 years old when the troops of Nazi Germany occupied Hungary, the boy had to tear down his Jewish origin. After the war, George moved to England in 1947 and enrolled at the London School of Economics. After graduation, he got a job as a stockbroker in New York and began to learn in practice all the subtleties of stock trading.

After graduation, he worked for several years in investment companies, and in 1973 he founded his hedge fund under his own name. In 1978 the Soros fund was renamed to Quantum Fund. The fund's success was largely due to the bold investment ideas of its founder and Soros' ability to forecast the situation of world stock and financial markets.

In 1992 the name of George Soros appeared on the front pages of newspapers - the financier predicted the withdrawal of Great Britain from the European exchange rate mechanism, made the right decisions and earned over a billion dollars at the Forex market for a day.

In 1997, he made some speculative operations on Asian currencies, in particular the Thai baht. He is considered to be one of the organizers of the Asian financial crisis in 1998. Some reports say that he was involved in the collapse of the Malaysian ringgit.

At the beginning of the new millennium, George Soros delegated the processes of active investment to the Fund's employees. For over 20 years he has been involved in philanthropic projects and political activities through his Open Society Foundations. The financier has donated over $32 billion of his personal fortune to the organization which fights for democracy and respect for human rights all over the world.

In the next article, we will tell you how George Soros managed to increase his capital.

___________

Also, if you want to use all available trading tools to increase your profits as soon as possible - follow this link below, or contact us via live chat. Our experts will help you to choose the best strategy for success.

Follow our updates for useful information in our series of articles.