How to use algorithmic trading advisors on Forex

- George Solotarov

- Hits: 433

A trading advisor is a file with written code. This file should be copied into the appropriate directory of the platform, provided that it supports adding custom software.

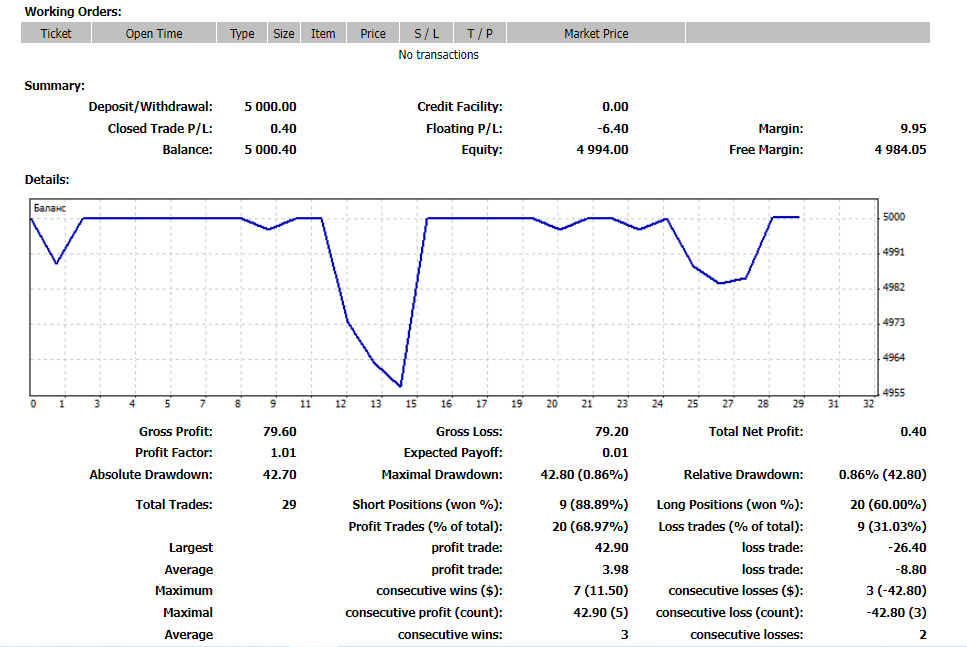

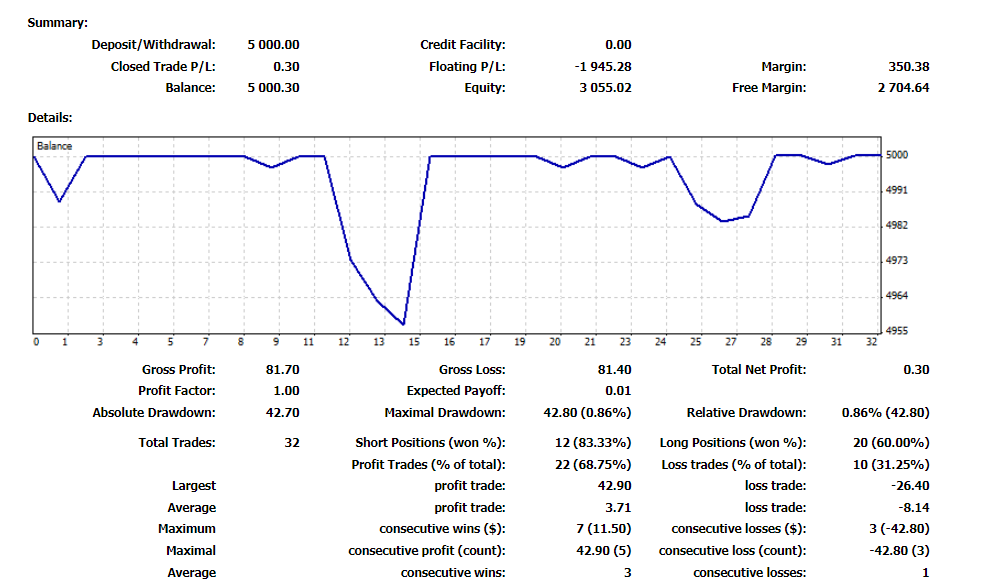

Stage 1: Testing. The most important stage, the most difficult and time-consuming. It represents the testing of the Expert Advisor on previous timeframes on several assets. The testing is conducted on different parameters of the Expert Advisor and lasts until the best possible result with the confirmed profitability of the Expert Advisor is obtained.

Step 2: Analysis. The backtest statistics are the basis for analysis. The backtest represents a report with statistics and the equity curve.

The explanation of each BeckTest statistic is the subject of a separate article. But each indicator is of fundamental importance, showing the performance of the Expert Advisor and the risk level.

Step 3: Run. Everything is simple here. Based on the test results, you can see the strong and weak points of the Expert Advisor. For example, if your Expert Advisor is effective only at night time and only on the USD/JPY pair, you should run it only at night time. This can either be done manually or you can download an auxiliary utility, which automatically starts and stops the advisor at the set time.

The main rule of application of Expert Advisors is the control of deviation of real statistics from test results. If the deviations of some indicators are critical, then even if there is profit, it makes sense to stop it and send it for optimization. Optimization - changes in settings and other parameters that improve the performance of the software.

In the next article, we will consider the testing of algorithmic trading Expert Advisors.

Also, if you want to use all available trading tools to increase your capital as soon as possible - follow this link below, or contact us via live chat. Our experts will help you to choose the best strategy for success.