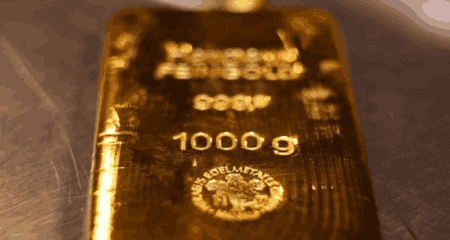

Gold Surges Above $2,700 as Global Interest Rates Fall

Gold prices continued their upward trajectory, reaching a new all-time high above the $2,700 level. The decline in global interest rates, particularly in Europe and Japan, has made gold a more attractive investment option.

Central Banks Accelerate Easing:

- The European Central Bank (ECB) lowered its deposit rate by 25 basis points, signaling a potential acceleration in its easing cycle.

- The Bank of Japan (BoJ) is less likely to raise interest rates due to lower-than-expected inflation data.

- The Bank of England (BoE) is now expected to cut interest rates in November.

US Data Suggests Less Aggressive Fed:

- Stronger-than-expected US retail sales and jobless claims data suggest the Federal Reserve may be less aggressive in cutting interest rates.

- Markets are now pricing in a higher probability of a smaller rate cut in November.

Technical Analysis:

- Gold's upward trend remains intact, with potential targets above $2,700.

- The Relative Strength Index (RSI) is overbought, indicating a potential for a pullback.

- Support levels are at $2,700 and $2,685.