What is Solana (SOL)?

- George Solotarov

- Hits: 379

Write comment (0 Comments)

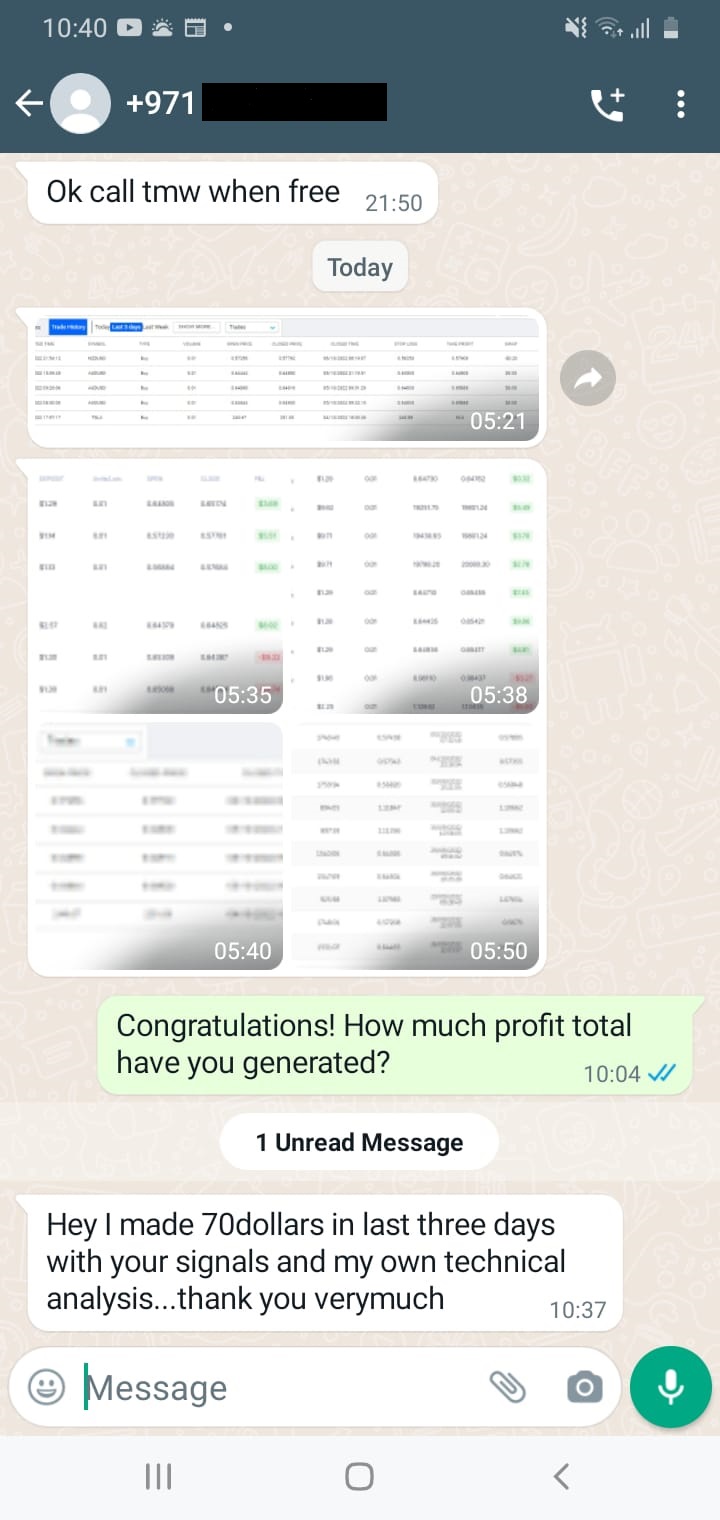

In the screenshot, you can see a detailed experience of successful deals made by one of our members in the last few days.

It is known that not only big victories are important, but also a series of small victories can absolutely bring you the desired success and joy.

This anonymous testimonial from one of our members and others like it is the purpose of our work. It's a pleasure for our editorial team to read your testimonials and see your successes achieved because of your determination and the work of our professional support team as well as the services we provide to optimize your trading experience.

Continue your education on the different types of data analysis, and take full advantage of the ToolsTrades services. And send us your feedback, we'll sometimes publish it anonymously so your successes can be an inspiration to others who will know that a series of small wins is just as important as the big ones.

Best regards, Your ToolsTrades Team.

Also, if you want to use all available trading tools to increase your capital as soon as possible - follow this link below, or contact us via live chat. Our experts will help you to choose the best strategy for success.

Page 65 of 100